Fundraising has always been a weird sport. You spend weeks polishing a deck, you finally hit “send,” and then…

silence. Or worse: a polite “not a fit” that tells you absolutely nothing, like a breakup text from someone who

also unsubscribed from your newsletter.

The core problem is simple: investors don’t have time to coach every founder, and founders don’t have time to

guess what the real objections are. That’s why the new SaaStr.ai VC Pitch Deck Review Tool is so

interesting. It’s aiming at the most expensive moment to get wrong: the first impression. The tool’s promise

is blunt (in the best way): help you see what VCs will think of your pitch deckbefore you pitchso you can fix the

stuff that kills fundraising from slide one.

Why Pitch Decks Fail (Usually Before Slide 5)

Most founders assume their deck gets judged like a school essay: read carefully, graded fairly, returned with

comments in the margins. In reality, pitch decks get judged more like airport security: fast, slightly suspicious,

and absolutely willing to confiscate anything that looks risky.

Investors are pattern-recognition machines. They’ve seen thousands of decks, so they’re looking for signals:

clarity, traction, a market with real heat, and a team that can execute. When a deck misses those signalsor tries

to hide the numbersinvestors don’t “debate it.” They move on.

Research and investor guidance repeatedly points to the same failure modes:

a foggy “what you do,” unrealistic market sizing, metrics that don’t reconcile, and a story that doesn’t answer

“why now?” fast enough. Even strong ideas can die if the pitch comes off as confused, evasive, or overconfident

without evidence.

The Classic Unforced Errors

- Word salad positioning: three lines of jargon where one clear sentence should be.

- TAM cosplay: “Our market is $400B” with no segmentation and no bottoms-up reality check.

- Traction vapor: lots of activity metrics, very few revenue-quality metrics.

- Unit economics blackout: CAC, LTV, churn, gross marginmissing or hand-waved.

- Competition denial: “We have no competitors” (translation: “we haven’t researched”).

None of these are fatal because founders are “bad.” They’re fatal because investors don’t have time to decode what

you meant. A deck has to be instantly legible.

So What Is the SaaStr.ai VC Pitch Deck Review Tool?

SaaStr.ai describes its pitch deck review product as an AI that “thinks like a VC” and is built specifically for

B2B SaaS (and B2B + AI). The headline value isn’t prettier slides. It’s feedback that targets the decision criteria

investors actually usethen scores and explains what’s working, what’s not, and what to fix first.

What It’s Trying to Do Differently

Lots of pitch tools are basically “templates with confidence.” Helpful, sure. But templates don’t tell you the hard

truth: which parts of your story feel fundable, which parts feel like wishful thinking, and which parts look like

a risk hiding behind design.

SaaStr positions this tool as different because it’s designed around real investor patterns and founder outcomes:

trained on founder conversations, portfolio pattern-matching, and investor frameworksthen updated based on what’s

working in the current funding environment. In other words: it’s trying to replicate the feedback you’d get if a

partner-level VC had time to be honest and specific (and had already had coffee).

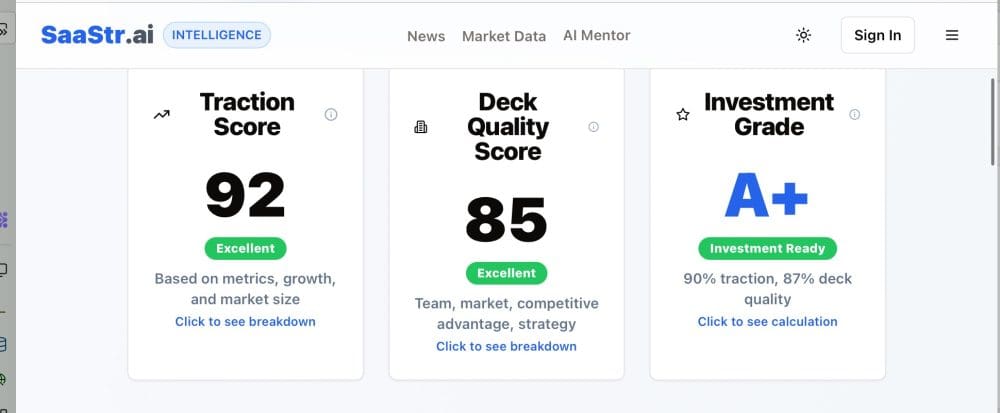

What You Get: Scores, Breakdown, and “Do This Next”

According to SaaStr’s description, the tool provides a detailed score breakdown across common investor lenses:

team, market, competitive advantage, growth strategy,

and even “market heat.” It also highlights priority improvements so you don’t waste time rearranging deck chairs on

the Titanic (or, in startup terms, changing your gradient color while your churn is on fire).

How Investors Actually Think When They Read Your Deck

Investors rarely ask, “Is this deck pretty?” They ask questions like:

Do I understand the problem? Is this solution meaningfully better? Can this team win? Are the numbers real? Does

the market support venture returns?

If you want your deck to feel “investor-ready,” it must answer three categories of questions quickly:

1) Clarity: What is this business, in one breath?

If your opening doesn’t land, the rest of the deck is a slow-motion apology tour. A strong deck starts with a crisp

declarative sentence and a simple narrative arc: problem → solution → why now → proof.

2) Evidence: What do the metrics say (and do they match)?

SaaS investors are obsessed with clean definitions. If you’re mixing bookings and revenue, or counting services as

recurring product revenue, you’re creating mistrust before the Q&A begins. Investors want to see how revenue is

generated, how it repeats, and how efficiently it scales.

3) Venture shape: Can this become big enough, fast enough?

VCs don’t need certainty. They need a plausible path to a very large outcome. That usually means a market with real

urgency, a differentiated wedge, and execution that compounds.

How to Use the Tool (Without Getting Defensive at Your Laptop)

If you want the SaaStr.ai VC Pitch Deck Review Tool to help, treat it like a mirror, not a fan club.

The goal isn’t to “win the score.” The goal is to surface what would block a real partner meeting.

Step 1: Upload the deck you’d actually send

Don’t wait until it’s “perfect.” The whole point is to catch the obvious deal-killers earlybefore you burn your

warm intros on a draft that wasn’t ready.

Step 2: Read the score like an investor would

If your deck gets graded as mediocre, that doesn’t mean your company is doomed. It means your pitch is currently

failing to communicate fundable signals. There’s a huge difference.

Step 3: Fix “priority improvements” before you touch design

The fastest way to waste a week is to obsess over slide layout when your business model slide doesn’t explain how

money shows up. Tackle what changes outcomes:

- Rewrite the one-sentence positioning until a stranger can repeat it correctly.

- Add a metrics summary slide with definitions (ARR, MRR, churn, gross margin, CAC, payback period).

- Replace TAM flexing with bottoms-up segmentation and a believable go-to-market path.

- Make competition honest: alternatives, status quo, and why you win anyway.

Step 4: Re-run the analysis after meaningful changes

Iteration is the game. Use the tool like a pre-flight check: run it, fix the most dangerous issues, run it again.

You’re not trying to get an A+. You’re trying to avoid a “pass” from investors.

Deck Structure That Usually Works (Because Humans Are Predictable)

Many investor frameworks converge on a similar structure: purpose, problem, solution, why now, market, competition,

business model, team, and financials. Not because investors love traditionbut because that sequence answers their

questions in the order they naturally occur.

A Practical 10–12 Slide Flow

- One-liner + who it’s for (clear, specific, no jargon)

- Problem (pain with a real customer story)

- Solution (what you do, how it works, why it’s better)

- Why now (tech shift, regulation, buyer behavior, distribution change)

- Market (segmented TAM + bottoms-up path)

- Product (screenshots, workflow, outcomes)

- Traction (ARR/MRR growth, retention, pipeline quality)

- Business model (pricing, ACV, margins, sales motion)

- Go-to-market (channels, ICP, wedge, sales efficiency)

- Competition (honest landscape + your edge)

- Team (why you can win this specific fight)

- Financials + raise (use of funds, milestones, runway)

If an AI tool flags your deck as “unclear,” it’s usually because one of these slides doesn’t do its jobor because

you’re mixing stages (seed deck trying to look like a Series C board meeting).

Specific Examples: Turning “VC Feedback” Into Deck Edits

Example 1: The Problem Slide

Before: “Teams lack visibility into productivity and alignment across initiatives.”

After: “Mid-market revenue teams lose deals because handoffs are manualforecast updates, renewal

risk, and account signals live in five tools. Our product gives revenue leaders one workflow to spot risk early and

close gaps weekly.”

The “after” version is specific, tied to a buyer, and points to urgency. Investors can now imagine who buys this and

why.

Example 2: The Market Slide

Before: “The market is $100B.”

After: “We start with 45,000 U.S. companies in our ICP (200–2,000 employees, inside sales motion).

At $18K ACV, that’s a $810M initial wedge. Expansion comes from multi-team adoption and adjacent workflows.”

Investors don’t need the biggest number. They need the most believable number that grows.

Example 3: The Metrics Slide (Where Trust Is Won)

A strong SaaS metrics slide doesn’t hide the messy parts. It defines terms and gives context. For example:

- ARR: $1.3M (subscription only, excludes services)

- YoY growth: 60% (with explanation: “repositioned to enterprise in Q2”)

- Gross margin: 82%

- Net revenue retention: 118%

- Logo churn: 7% annualized (SMB cohort), 2% (mid-market cohort)

- CAC payback: 11 months (blended), 8 months (mid-market)

The magic isn’t the numbers. It’s the honesty. Investors can smell metric manipulation like it’s a gas leak.

What the Tool Won’t Do (And Why That’s Good News)

The SaaStr.ai pitch deck review isn’t a traction generator, a market inventor, or a “please ignore the churn” wand.

And that’s exactly why it can be useful. It’s trying to help you present fundamentals clearlybecause no amount of

deck polish fixes a business model that doesn’t work.

If your deck score is low, the best outcome is not “rewrite harder.” The best outcome is:

identify the real gappositioning, go-to-market, unit economics, or proofthen decide whether to

fix the deck or fix the business first.

After You Improve the Deck: Validate With Real-World Investor Behavior

A pre-pitch review tool is one side of the loop. The other side is what happens when you actually send the deck.

Modern fundraising is increasingly data-driven: founders track opens, time spent per slide, and whether the deck

gets forwarded internallybecause that behavior often predicts interest long before someone replies.

Tools like DocSend popularized the idea of measuring engagement: who viewed, what they focused on, and where they

dropped off. That data can reveal which slides confuse people and which slides trigger deeper diligence.

A Simple “Two-Loop” System

- Loop A (before outreach): use the SaaStr.ai review to remove unforced errors and sharpen the story.

- Loop B (during outreach): track engagement to see what investors actually react to, then refine version-to-version.

If investors spend a lot of time on your business model slide, your follow-up should proactively answer pricing,

margins, and sales efficiency. If they bounce early, your opening is not landingor your first slides feel like

“homework.”

Who This Tool Is For (And When It’s Most Valuable)

Ideal use cases

- First-time founders who don’t have an operator/VC advisor doing redlines.

- Technical founders whose deck explains the “how” but not the “why buy.”

- B2B SaaS teams preparing seed or Series A and needing clearer metrics storytelling.

- Founders who keep hearing “not a fit” and suspect the deck is the real culprit.

Moments when it’s less useful

- If you’re pre-traction and your story depends on assumptions you can’t validate yet.

- If your market thesis is experimental and doesn’t fit standard SaaS patterns (you may need bespoke narrative work).

- If you want a tool to “make investors say yes” (nobody has invented that, and if they did, it would be illegal in at least 12 states).

A Founder-Friendly Checklist Before You Pitch

- Can a stranger explain what you do after reading slide 1?

- Do your metrics reconcile (ARR definitions, services excluded, bookings vs revenue clarified)?

- Is “why now” real (a shift, not a vibe)?

- Is your market sizing segmented with a bottoms-up wedge?

- Is competition honest (including substitutes and status quo)?

- Is the go-to-market specific (ICP, channel, sales motion, economics)?

- Do you show a credible path to meaningful scale (not just “we’ll grow a lot”)?

Conclusion: “Know Before You Pitch” Is the Real Superpower

The best pitch decks don’t “sell.” They clarify. They make it easy for investors to believe three things:

the problem is urgent, the solution is differentiated, and the team can execute with numbers that hold up under

pressure.

The new SaaStr.ai VC Pitch Deck Review Tool matters because it attacks the most common fundraising failure: founders

learning what’s wrong only after they’ve already spent their best intros. If it helps you fix the obvious mistakes,

define your metrics cleanly, and tell the story the way investors actually process it, it can save months of

frustrationand maybe a few late-night “should we just bootstrap forever?” conversations.

You’ll still need a strong business. You’ll still need real proof. But if you can remove the unforced errors and

walk into conversations with a deck that reads like a fundable company, you’ve already made the game easier.

Not easy. Just easier. (Startups are still startups. No tool can fix that part.)

Experiences: What It’s Like to Pressure-Test a Pitch Before You Pitch (500+ Words)

Founders don’t usually talk about the emotional side of pitch decks, but it’s real. A deck feels like a biography,

a plan, and a personality test rolled into one. So when you run it through a VC-style review toolespecially one

marketed as “brutally honest”the experience can be surprisingly intense in a useful way.

Experience #1: The “Wait… That’s What You Think We Do?” Moment

A common reaction is discovering your positioning isn’t landing. Not because it’s wrong, but because it’s written

like an internal Slack message. Founders often realize their opening slide answers, “What category are we in?” but

not “What do we actually deliver?” The fix usually isn’t bigger wordsit’s smaller ones. Instead of

“AI-powered workflow orchestration,” it becomes “We cut onboarding time in half for IT teams by automating setup

across tools.” Same product. Totally different comprehension speed.

Experience #2: Metrics Transparency Feels Scary… Until It Feels Powerful

Many teams hesitate to show churn, payback period, or pipeline conversion because they’re afraid it will “look bad.”

But in practice, hiding metrics often looks worse than having imperfect metricsbecause investors assume the missing

numbers are catastrophic. The “aha” moment is realizing that clean definitions and context build trust:

“Churn is higher in SMB; we’re intentionally moving upmarket,” reads like an operator. “We don’t track churn yet,”

reads like someone who hasn’t felt pain. Once founders rewrite their metrics slide with clear definitions (ARR

excludes services, CAC payback calculated consistently, cohorts separated), the deck starts to feel like a business,

not a wish.

Experience #3: The Competition Slide Turns Into a Credibility Slide

Founders often treat competition as a threat to downplay. Investors treat it as a test of realism. When teams get

feedback that their competition slide is weak, the best outcome is not listing more logosit’s mapping the decision

alternatives: status quo, in-house builds, point solutions, suites, and “do nothing.” Suddenly the slide becomes a

demonstration of market understanding. Founders frequently report that once they make this slide honest, the rest

of the deck tightens naturally because they’re forced to explain their edge clearly: why buyers pick them, why now,

and why that edge persists.

Experience #4: The Tool Becomes a Weekly “Deck Standup”

Another common pattern is operational: teams stop treating the deck like a one-time fundraising artifact and start

treating it like a living strategy doc. A founder or head of finance runs a new version after a pricing change, a

new cohort result, or a sharpened ICP. The output becomes a to-do list:

“Clarify go-to-market,” “Define ACV,” “Explain expansion motion,” “Show pipeline quality.” That list gets turned

into real workimproving the business, not just the slides.

Experience #5: The Best Part Is Confidence, Not Compliments

The most valuable “experience” founders describe isn’t getting a high scoreit’s walking into investor conversations

knowing what questions are coming. If your deck is clear on the fundamentals, you don’t spend the first meeting

defending basic definitions. You spend it discussing strategy, risks, and upside. That shift is subtle but huge:

it changes the tone from “convince me you’re real” to “let’s explore whether this can be big.”

In that sense, the promise of knowing what investors will think before you pitch isn’t mind-reading.

It’s preparation. It’s turning fundraising from a guessing game into a process: clarify, measure, iterate, and only

then amplify through intros. And in a market where attention is scarce, being the founder who shows up with clarity

is a competitive advantage all by itself.