“Why don’t I just put everything in stocks and get rich faster?”

If you’ve ever looked at a long-term chart of the stock market and asked yourself that question, you’re in good company. Many seasoned investors, including pros like Ben Carlson of A Wealth of Common Sense, have openly talked about running 100% stock portfolios for their own retirement money.

On paper, investing 100% in stocks looks like the ultimate power move: higher expected returns, more compounding, and the chance to hit your financial goals sooner. In practice, though, it’s more like riding a roller coaster with no seat belt. You might love the thrill in your 20s, but by the time you’re staring down retirement, that same ride can feel downright terrifying.

In this guide, we’ll break down what it really means to invest 100% of your portfolio in stocks, where the “common sense” is, where the hidden landmines are, and how to decide whether this aggressive strategy fits your realitynot just your daydreams.

Why 100% Stocks Sounds So Smart (On Paper)

1. Historically, Stocks Have Paid More Than Bonds

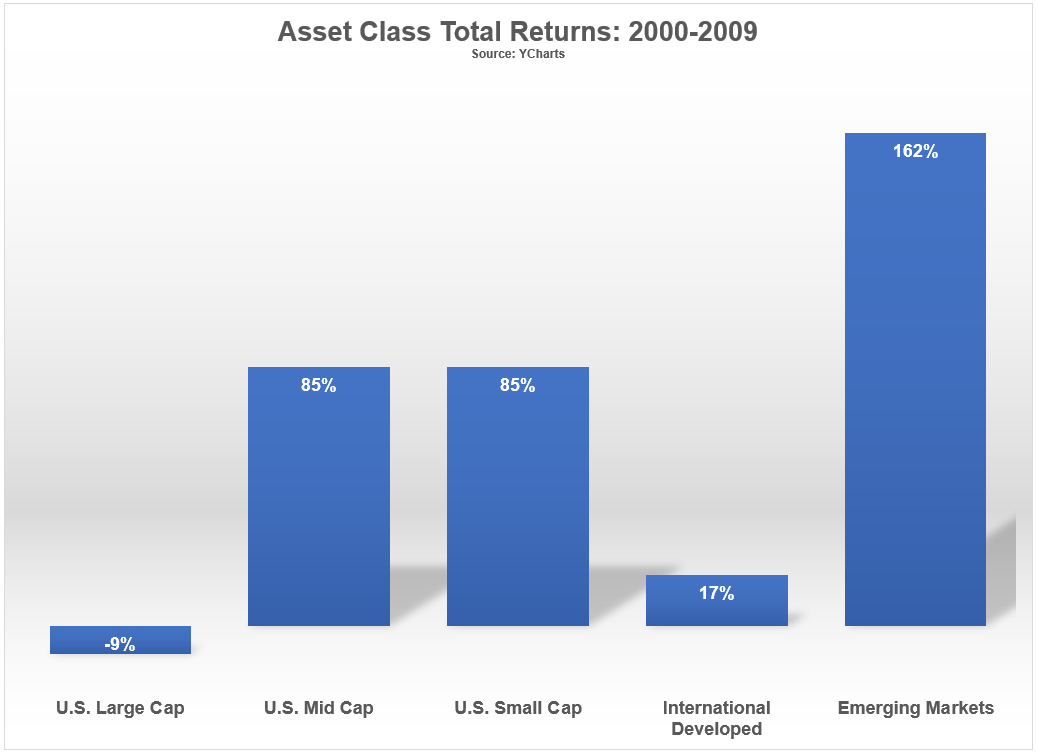

Over long periods, stocks have delivered higher returns than bonds and cash. That’s not marketing; it’s history. U.S. stock markets have generally returned more than fixed income over decades, which is exactly why some investors argue you should be all-in on equities for the long haul.

Research comparing all-stock portfolios to traditional balanced portfolios (like 60% stocks / 40% bonds) often finds that, over very long horizons, 100% equities can produce more wealth at retirementsometimes 30% or more compared with mixed stock–bond portfolios.

Translation: if you stay invested, don’t panic-sell, and give your portfolio decades to work, stocks have historically rewarded patience more than any other mainstream asset class.

2. Time Horizon Can Be Your Superpower

The big argument for a 100% stock portfolio is simple: if you’re young, have a long time until retirement, and won’t need the money for decades, you can ride out the storms. Target-date funds designed for younger investors often use 90/10 or similarly aggressive allocations, keeping most of the portfolio in stocks for many years.

In that context, 100% stocks is basically the “spicy” version of a 90/10 portfolio: slightly more risk, slightly more expected return, and a lot more responsibility for you to handle the emotional side.

3. Simplicity Is a Feature, Not a Bug

One of the core messages in the book A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan is that simple portfolios often work better than complex ones people can’t stick with.

An all-stock plan built from a handful of broad, low-cost index funds is extremely easy to understand and maintain:

- Total U.S. stock market index fund

- Total international stock market index fund

- Automatic contributions every month

That’s it. No fancy timing, no picking “the next Tesla,” just common-sense ownership of global businesses.

The Big Catch: Risk, Volatility, and Your Nerves

4. A 100% Stock Portfolio Can Drop 30–50% (Or More)

Here’s the part the spreadsheets don’t feel: the gut-punch. During severe bear markets, all-stock portfolios can lose half their valuesometimes morebefore recovering. Bonds are usually there to cushion the fall. When you own none, you feel every bump.

Historically, balanced 60/40 portfolios have often fallen far less than pure stock portfolios during big crashes and recessions, even if they lag in certain bull markets.

Imagine retiring with $1 million, 100% in stocksand then the market drops 40% in your first couple of years. Now you’re down to $600,000 while also withdrawing money to live on. That’s called sequence of returns risk, and it’s a major reason many planners warn against all-equity portfolios for retirees.

5. Most People Overestimate Their Risk Tolerance

On paper, almost everyone is fearless. In real life, a lot of those “I can handle big swings” people turn into “Sell everything, I’ll get back in later!” at the worst possible time.

Behavioral finance research and countless investor horror stories show that the biggest risk isn’t the marketit’s our own reactions to it. Many advisors who start out fully in stocks eventually add bonds not because the math demands it, but because human emotions do.

Put differently: a 100% stock portfolio that you can’t stick with is worse than a 60/40 portfolio you actually stay invested in.

6. 60/40 Sometimes WinsEven Over Decades

Another uncomfortable truth: depending on the exact start and end dates, a classic 60/40 portfolio has outperformed 100% stocks over many rolling 20–25 year periods.

Why? When stocks get hammered, bonds often hold up or even rise, which reduces the depth of drawdowns and allows balanced portfolios to recover on a smoother path. If you happened to start investing just before a long stretch of poor stock performance, the “boring” bond piece may have saved your results.

Who Might Consider a 100% Stock Portfolio?

7. Young Investors With Stable Income

If you’re in your 20s or early 30s, have a secure job, no plans to touch your investments for decades, and a high tolerance for seeing your account balance swing wildly, an all-stock portfolio can be a reasonable option.

Many aggressive “rule of thumb” formulas, like “110 minus your age in stocks,” still wouldn’t put you at a full 100%, but they come close for younger investors. Recent commentary even suggests using “120 minus your age” for those with strong risk tolerance and long life expectancy.

8. Investors With a Large Safety Net

A 100% stock portfolio is less scary if:

- You have a big emergency fund (6–12 months of expenses).

- Your job is relatively recession-resistant.

- You have other stable assets: a paid-off home, pensions, or guaranteed income sources.

In that case, your investment portfolio can function more like a long-term growth engine rather than your only lifeline.

9. People Still in the “Accumulation” Phase

If you’re decades away from withdrawing money, market crashes are painful, but they also let you buy more shares at lower prices. Contributions during bear markets can dramatically improve long-term results. For these investors, staying 100% in stocks throughout accumulation may be reasonableif they can calmly ride out the turbulence.

Who Probably Should Not Be 100% in Stocks?

10. Near-Retirees and Retirees

If you’re within 5–10 years of retirement, having everything in stocks is usually a bad idea. This is when sequence of returns risk becomes very real: a severe downturn early in retirement can do permanent damage to your plan.

Many planners recommend shifting to a more balanced allocation as you approach retirement, using bonds and cash to cover several years of living expenses while letting your stocks recover after a downturn.

11. Anyone Who Lost Sleep in the Last Bear Market

Be honest: how did you feel during the last major sell-off? If you were glued to your phone, stressed out, or tempted to sell everything, a 100% stock portfolio is probably not for youno matter how convincing long-term charts look.

Your portfolio should help you live your life, not cause you to obsess over the market every day.

How to Build a Common-Sense 100% Stock Portfolio

12. Use Broad, Low-Cost Index Funds

If you decide a stock-only portfolio fits your situation, keep it simple. A common structure looks like:

- 50–70% U.S. total stock market index (large, mid, and small caps)

- 30–50% international total stock market index (developed and emerging markets)

This gives you exposure to thousands of companies around the world in just two or three fundsno stock picking required, and very low fees.

13. Automate Contributions and Rebalancing

The more automatic your plan, the less likely you are to sabotage it. Set up:

- Automatic monthly contributions from your paycheck or bank account

- Automatic reinvestment of dividends

- Periodic rebalancing between U.S. and international stocks (once or twice a year is usually enough)

The goal is to take emotion out of the process so you don’t “feel” every dip as a decision point.

14. Consider a Glide PathEven if You Start at 100%

Many people who start at 100% stocks don’t stay there foreverand that’s okay. A common-sense approach is:

- Stay 100% in stocks during early and mid-career.

- Gradually add bonds or cash 10–15 years before retirement.

- By retirement, hold several years of living expenses in safer assets.

This lets you enjoy the growth potential of stocks early on while still respecting the reality that you’ll eventually need your portfolio to behave more like a paycheck and less like a roller coaster.

A Quick Common-Sense Checklist

Before you decide to go 100% in stocks, ask yourself:

- Can I emotionally handle a 40–50% drop without selling?

- Am I more than 10–15 years away from needing this money?

- Do I have a solid emergency fund and stable income?

- Is my plan simple, low-cost, and easy to maintain?

- Have I considered a more balanced option and still prefer the risk of 100% stocks?

If you answered “no” to several of these, you may want to dial back the risk. Remember: investing is not a bravery contest. The best portfolio is the one you can actually live with through good times and bad.

Real-World Experiences with a 100% Stock Portfolio

Theory is great, but money is emotional. Let’s look at how an all-stock approach can feel in real life, based on patterns financial writers and investors frequently share.

The Young Engineer Who Went All-In

Alex, 27, works as a software engineer, has no debt, and loves numbers. After binge-reading investing blogs and seeing long-term stock charts, Alex decided, “Why bother with bonds? I’ll just go 100% stocks.”

For the first few years, it’s glorious. The market mostly goes up, Alex keeps buying index funds, and the net worth graph climbs like a rocket. Every dip looks like a Black Friday sale. Friends who keep money in savings accounts are called “too cautious” in group chats.

Then a brutal bear market hits. In six months, Alex’s portfolio drops more than 35%. Suddenly, those neat spreadsheets feel less fun. It’s one thing to imagine losing a third of your moneyit’s another to watch the actual dollar amount vanish.

The turning point? Alex had:

- A full year of expenses in cash

- No immediate need to sell investments

- A pre-written plan stating “I will not sell my index funds in a bear market”

Because of that, Alex stuck to the strategy, kept contributing through the downturn, and years later, the portfolio not only recovered but reached new highs. For someone with this combination of temperament, safety net, and discipline, 100% stocks worked.

The Almost-Retired Couple Who Stayed Too Aggressive

Now meet Lisa and Mark, both in their early 60s, who had done well with a stock-heavy portfolio for decades. They enjoyed the strong returns and figured, “We’ve made it this far all in stockswhy change now?”

They planned to retire in two years. Then the market tanked, and their all-stock portfolio dropped close to 40%. Overnight, their “comfortable retirement” turned into “we might have to work five more years.” The problem wasn’t just the drop; it was that they had no cushion to withdraw from while stocks were down.

In panic, they moved a huge chunk into cash after the crash, locking in losses. What hurt them most wasn’t choosing 100% stocks decades earlier; it was failing to shift to a more balanced allocation as retirement got closer.

The Balanced Investor Who Slept Better

Contrast that with Sam, who started with heavy stock exposure in their 30s and gradually transitioned to a mix of stocks and bonds approaching retirement. Over 30+ years, Sam’s returns may be slightly lower than an all-stock investor’s in some scenarios, but the ride was much smoother.

During rough markets, Sam’s 60/40 portfolio fell less, and there was always a bond cushion to rebalance from or sell for living expenses. That meant fewer sleepless nights and no panicked, mid-crash allocation changes. In several historical windows, investors like Sam actually ended up ahead of 100% equity investors because they avoided large drawdowns and could stay the course more easily.

What These Stories Really Tell You

The lesson isn’t “100% stocks is always good” or “bonds are always better.” The lesson is:

- High stock exposure rewards those who can stay invested through ugly declines.

- As you approach the point where you need to spend your money, volatility matters more than raw return.

- A plan you can follow beats a “perfect” strategy you abandon at the worst moment.

When you read confident blog posts or research papers that argue in favor of 100% equities for long-term investors, remember: those models assume a perfectly rational investor with no panic button. In the real world, your emotions are part of the portfolio, whether you admit it or not.

So, if you’re drawn to the idea of investing 100% of your portfolio in stocks, make sure you’re not just chasing numbers on a screen. Be honest about your risk tolerance, build a strong financial cushion, and have a realistic plan to gradually dial back risk as your life changes. That’s not just investingit’s using a little wealth of common sense.

Conclusion: All Stocks, Some Bonds, or Just Good Sense?

Investing 100% of your portfolio in stocks can be a powerful strategy for the right person at the right stage of life. The math of long-term returns is compelling, and the simplicity is attractive. But markets don’t pay you those higher returns for freethey charge in volatility, anxiety, and the risk of brutal losses at the wrong time.

If you’re young, well-prepared, and emotionally wired to handle big swings, a 100% stock portfolio may fit your goalsespecially if you commit to a clear plan and a future glide path into safer assets. If you’re closer to retirement or already withdrawing from your portfolio, some mix of bonds and cash isn’t just traditional; it’s common sense.

In the end, the smartest portfolio isn’t the one that looks best in a backtest. It’s the one that lets you build wealth and sleep at night.